20+ Conventional 97 loan

PNCU has a variety of home loan programs depending on your borrowing need. By comparison making a 20 down payment would require 70000 upfront.

/dotdash_Final_How_is_a_Cost_of_Living_Index_Calculated_Oct_2020-01-f5552b1a61f44bc38cf63bee4f1b67b0.jpg)

How Is A Cost Of Living Index Calculated

Ad Buying refinancing upgrading or downsizing.

. For multi-unit homes located in high-cost areas loan limits are even higher. With a Conventional 97 loan you can pay as little as 3 down. The 97 in the name refers to the loan-to-value ratio of 97 that youll have when you.

As the name implies a Conventional 97 loan is a mortgage that allows you to have a loan-to-value LTV ratio of as high as 97. For example a 4-unit home in Honolulu. 5 to 1999 down.

Conventional loans can also offer adjustable-rates that change in accordance with broader market conditions. Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison. Bank Has Mortgage Loan Officers To Guide You Through Our Conventional Loan Options.

And if youre aiming for 20 to save you the monthly. From the 10 down piggyback loan to 3. For most conventional loans your DTI must be 50 or lower.

Find the Housing Loan You Need. Apply Easily Get Pre Approved In Minutes. Ad We Offer Competitive Fixed RatesFees Online Tools - Start Today.

Choose Your Loan Type. Find A Lender That Offers Great Service. For a conforming conventional loan your loan must fall within the loan limits set by Fannie Mae and.

Ad Explore Quotes From Top Lenders All In One Place. The property is a one-unit single-family home co-op PUD or condo. APGFCUs Conventional 97 and 95 programs 1 offer even more options to help you move into your first house without.

A conventional 97 loan is a type of mortgage loan that requires a down payment of just 3. Your Top-rated FHA Lender. Purchase Options for 97 LTVCLTVHCLTV.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Additional conventional 97 loan requirements in 2022 include. Ad 10 Best Mortgage Rates of 2022.

HomeReady income limits are integrated in DU or can be found using the Income Eligibility Lookup tool. The Conventional 97 mortgage was created to serve as something of an alternative to loans backed by the Federal Housing Administration FHA giving potential buyers more options. Ad Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offer.

Increased loan amounts are also available for 2- 3- and 4-unit homes. 2019 conventional 97 ltv. Many buyers choose a 30-year fixed-rate conventional loan because it usually results in an affordable monthly payment but shorter terms are also available.

Piggyback loan no PMI. Top 10 Mortgage Lenders To Finance Your New Home. 35 down with a 580 credit score or 10 down a score between 500-579.

On a 200000 loan that amounts to 10000. Like other conventional loans conventional 97 applicants will pay. The definition of a.

Check Out the First-Time Home Buyer Program On Our Official Website. Conventional loan with PMI. The 97 loan always beats the FHA loan on down payment.

We have the right mortgage program for you. Compare More Than Just Rates. Ad New American Funding Get A Quote.

Ad Own A 150000 Home With A 4500 Down Payment. Ad Own A 150000 Home With A 4500 Down Payment. This means that if youre purchasing a home with a 100000.

Conventional loan with no PMI. Find Out How With Quicken Loans. May 17 2017 April 20 2017 JMcHood 0 Comments conventional 97 mortgage conventional mortgage guidelines fannie mae loan programs new home buyer loans.

Find Out How With Quicken Loans. The 97 loan is superior to the FHA mortgage when the loan amount exceeds the customary FHA 294515 loan amount. Click here to check your eligibility for the conventional 97 LTV program Sep 21st 2022.

80 of AMI in all census tracts. Some lenders also offer 10-year 15-year and 20-year fixed rate loans. But conventional loans generally require a down payment of at least 5.

The new conventional 97 LTV program is a safer bet for the future requiring no upfront mortgage insurance fees and cancellable monthly PMI. The mortgage is a fixed-rate loan. Just An Estimate Is Fine.

That means the loan-to-value or LTV ratio can be up to 97 hence the 97 in the name Conventional 97. Get my lender match. First-time homebuyers can qualify for Conventional 97 Mortgages with a 3 down payment which is lower than the 35 down payment required on FHA loans.

The loans you know with down payments that will surprise you.

Is 10k An Acceptable Down Payment On A 300k Home Quora

Consumer Food Beverage Harris Williams

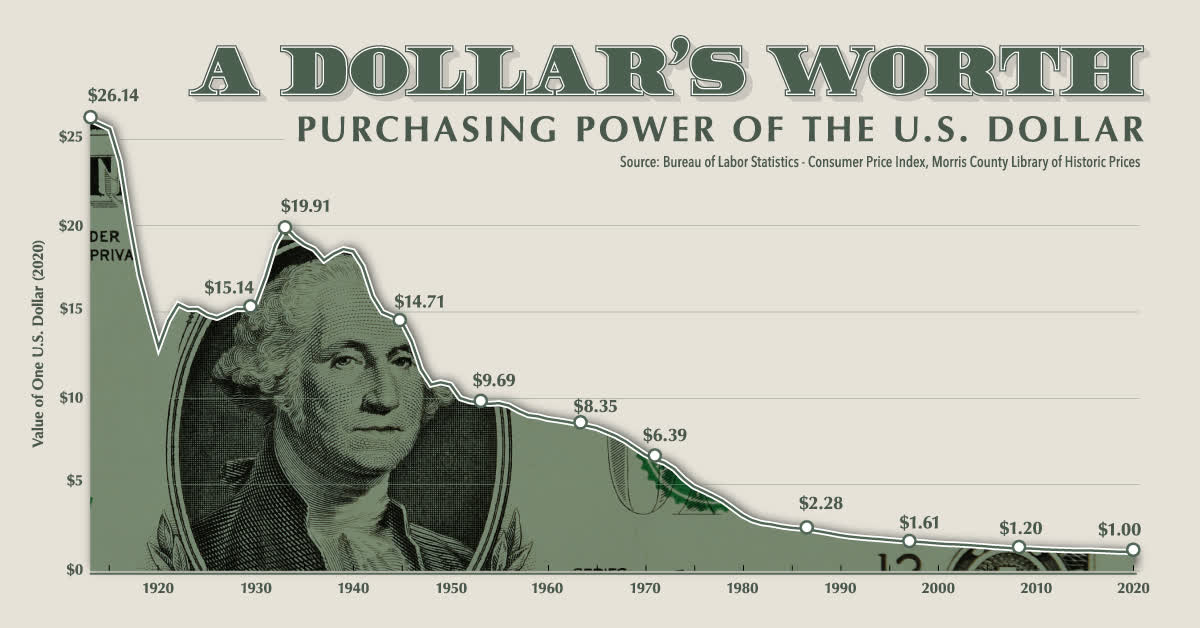

Debunking Myths Of A U S Monetary Collapse 10 Years Later Seeking Alpha

World S 20 Worst Epidemics And Pandemics In History Download High Quality Scientific Diagram

/Term-Definitions_keynesianeconomics_FINAL-4ad61de091a145d1825329ce64f0fa93.png)

Keynesian Economics Theory Definition And How It S Used

Minimum Down Payment For A Conventional Loan In California

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

How Cash Out Refinancing Works Find My Way Home

3 Ways To Not Pay Private Mortgage Insurance Find My Way Home

2

Cytodyn It Only Takes One Hit Otcmkts Cydy Seeking Alpha

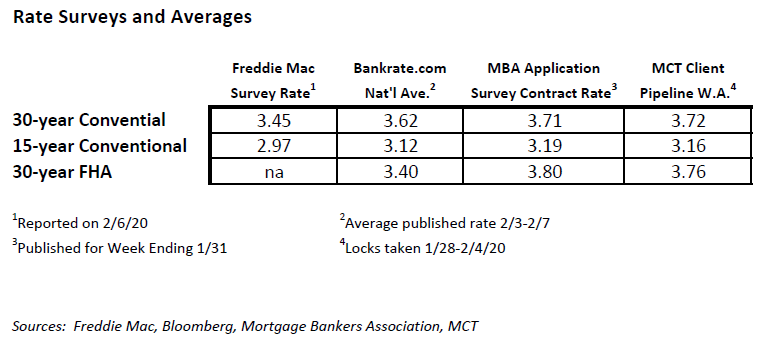

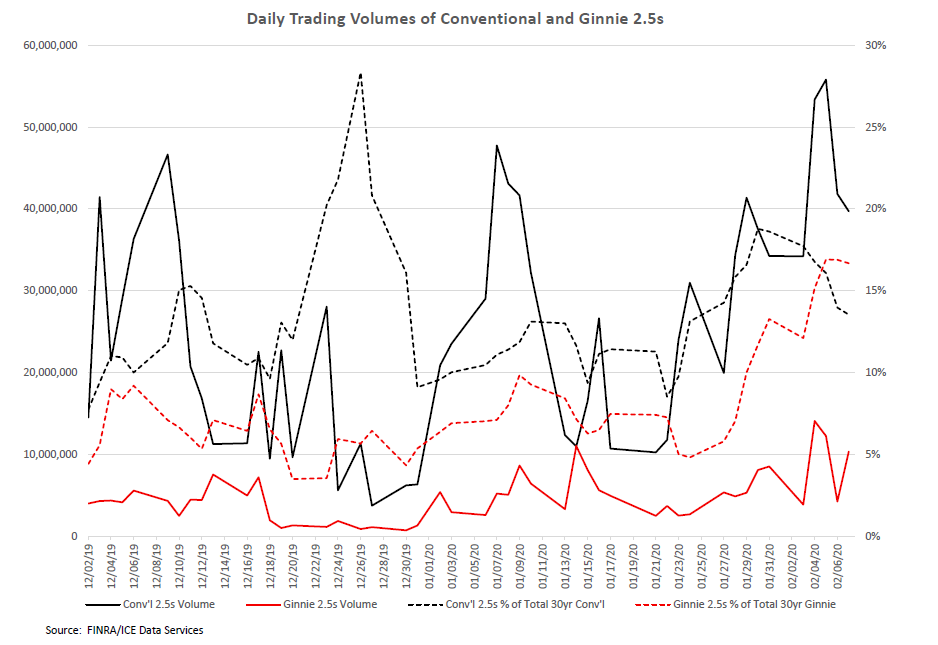

Mbs Weekly Market Commentary Week Ending 02 07 20 Mortgage Capital Trading Mct

World S 20 Worst Epidemics And Pandemics In History Download High Quality Scientific Diagram

Mbs Weekly Market Commentary Week Ending 02 07 20 Mortgage Capital Trading Mct

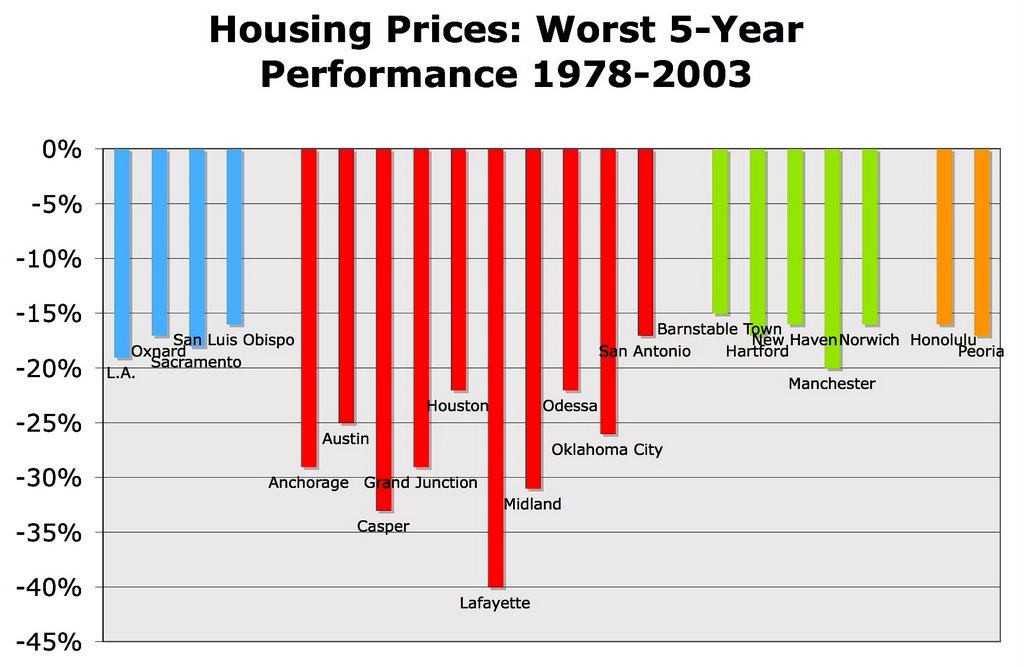

Generation Risk Blog Money Magazine

Ex 99 1

2